Sensibull is an options trading firm formed by Abid Hassan and Abhimanyu, who have invested 2.5 crores in it. The business just created an ‘Options trading platform,’ which promises to make Options trading simpler and faster for small traders. Based on a trader’s market outlook, the platform recommends a set of tactics. Furthermore, it offers you all the necessary information such as trade, strike prices, risk, profit and loss possibilities, and so on. You may also compare several Option methods to see which one is best for you.

What is Sensibull?

Sensibull is an options trading software that facilitates the construction of options strategies by recommending a variety of approaches based on your own market outlook. Before you join the options transaction, Sensibull gives all of the necessary information such as risk, volatility, and profit/loss possibilities.

For example, say you have to believe that the Nifty will rise 200 points in 14 days but are unsure which option strategy will be most effective and will maximize your profits or cut loss..

Then, on the Sensibull site, enter your market estimates and press the go button. Sensibull will develop unique buy/sell option strategies for each approach, including profit, ROI, breakeven, and maximum profit/loss figures.

How does Sensibull work?

Assume you believe the Nifty will rise by 100 points in the next few weeks. You must input the following information:

NIFTY Outlook- Here you have five options to express your market view. Choose the most relevant market perspective.

Nifty Target– Enter the price at which you expect the underlying will trade.

Objective Date- Enter the date by which the underlying is expected to reach the price target.

When you press the ‘Go’ button, you will be given a selection of Options trading techniques that are ideal for your market outlook, as well as profit potential, capital required, return %, and so on. You can learn more about each strategy by clicking the ‘Expand’ button, where you can learn more about the number of legs in the strategy, risk and return potential, and so on.

You can also filter the recommended strategies depending on the instrument’s Action (Buy or Sell) and Expiry Date.

The tool allows you to evaluate proposed tactics and calculate the profit and loss in various circumstances. You may adjust the place, dates, IVs, and other parameters of each strategy to find the best one for your trade.

After deciding on a plan, you may place your order immediately from the platform.

Sensibull also provides handy features for options traders such as:

Event Calendar- The calendar focuses on the most significant events, FnO outcomes, and worldwide events that might affect your trade and alerts you to event risk throughout the site. It monitors macro events as well as FNO outcomes.

Predictive Securities Transaction Tax (STT)– It predicts STT taxes on options contracts that expire in ITM.

Options Analyzer- It does a thorough examination of an Options contract, including Option Greeks, Option Chain, Scenario analysis, and trading P&L.

Futures Conversion and Implied Weekly Futures- It converts an option to applicable futures depending on the specified spot price for your target day. Because weekly Options do not have weekly futures contracts, it generates the implied weekly futures for Bank Nifty.

Enhanced Option Chain- The Option Chain visualises the whole OI accumulation picture at a single glance. It has real-time Greeks, event alerts, IV Percentile, PCR, and other features.

Option Central- It assists traders in identifying options trading chances by examining IV percentiles, OI Buildups, PCR, Events, Volume Breakouts, and other indicators.

Sensibull Charges & Pricing:

Sensibull has ties to only Zerodha, 5paisa, Motilal Oswal, or Alice Blue and a few other brokers.

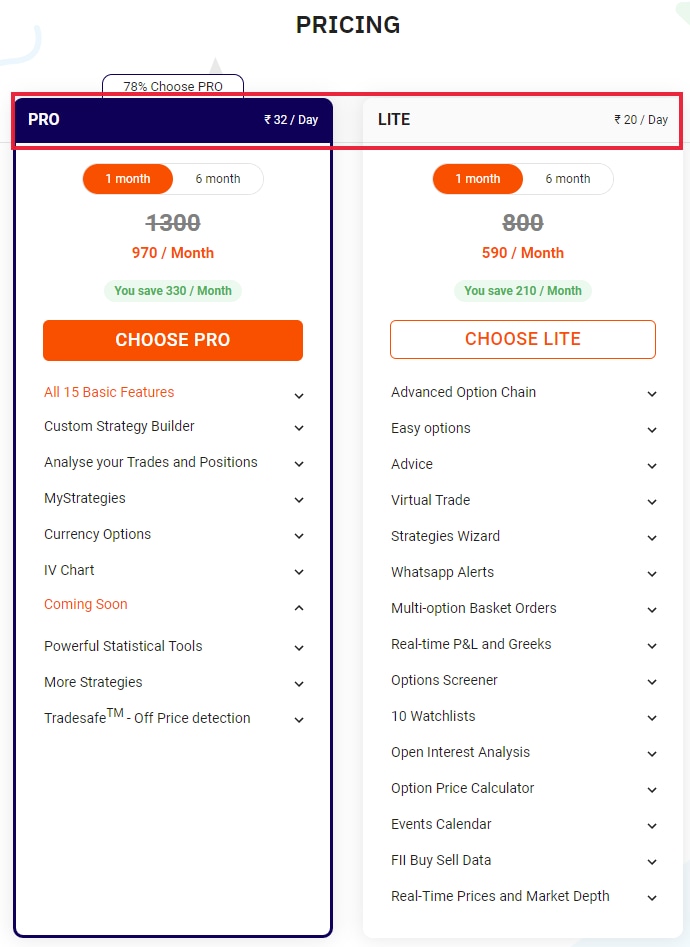

Sensibull provides three plans: Pro, Lite, and Free (for a maximum of 14 days).

The Pro plan includes sophisticated tools and features such as Implied Volatility (IV) charts, strong statistical tools, currency options, and all of the Lite plan’s capabilities. The Pro plan is designed for experienced options traders.

The Lite plan includes an option chain, strategies wizard, real-time Profit & Loss, 10 watchlists, open interest analysis, and other features. The Lite strategy is best suited for beginning option traders.

Down below are the Sensibull pricing details on Zerodha:

Sensibull Characteristics and features:

Develop Option Strategies :

Sensibull works with you to create options trading strategies based on your market impressions. It also notifies you of upcoming events that may have an impact on your strategies, such as GDP figures, RBI policy, and company outcomes.

Ordering Made Simple:

After you’ve decided on a strategy, you won’t have to enter individual buy/sell orders on your broker’s site.

Sensibull provides a platform that is linked with your brokerage. Sensibull fills up the order form for you, and all you have to do is make the order for your chosen strategy.

Evaluate Your Options:

If you are undecided between two or more strategies, you may combine them to compare strategies and examine the P&L in different situations.

You may alter the location, dates, implied volatility (IVs), and ultimately choose the optimal option strategy.

Built-in Insights:

Sensibull alerts you to any potential occurrences, such as a company’s corporate activity, such as a stock split, rights issue, or continuing repurchase, that may have an impact on your transaction.

Details such as the influence of GDP statistics, RBI policy, and FII activities are also included in the insights.

Chain of Options:

The Option Chain provides a visual representation of the full open interest buildup for any company or index registered with Sensibull.

On the option chain screen, you can see detailed data like real-time Greeks, built-in event notifications, and the proportion of implied volatility, among other things.

Any Day Options Strategy:

In general, market strategy engines advocate option strategies for the expiry date.

Sensibull, on the other hand, allows you to trade options strategies on any day of your choosing, including the option expiry date.

Sensibull with Zerodha:

If you have a Zerodha, 5paisa, IIFL, Angel Broking etc… You can avail of the 7-day all-access Pro trial and I will encourage you to at least give it a try.

If you are a Zerodha account holder then you use some free Features on Sensibull.

Sensibull’s Advantages and features I like:

- The platform for trading options that is simple

- Linked to a stockbroker

- Option chain and strategy builder are two examples of features.

- Factors influencing the expected impact of events on strategy

- Every day’s option strategy

A place for Improvement:

- Other indices, such as the Sensex, must be included (currently has only Nifty and Bank Index only)

- There should be seamless integration with other stockbrokers

Conclusion:

Sensibull, the options trading platform, makes the life of an options trader easier. The platform’s advantage is that it combines aspects of a strategy engine that proposes option strategies to users with a trading platform that allows the strategy to be executed. It also simplifies the execution of sophisticated strangling techniques like strangles, straddles, and so on with a single click. To put it simply, the platform eliminates a lot of arithmetic and technical complexities in order to make trading simpler and easier.