Bajaj Power owns a 100% stake in Bajaj Energy and intending to offer its stake through Bajaj Energy IPO to raise an expected Rs 5,450 crore through an underlying for sale deal offer.

Bajaj Power documented its Draft to SEBI in August 2019 and got a-go-go from the controller.

As per DRHP, through the Bajaj Energy Initial Public Offering, an all-out new issue of Rs 5,450 crore will be on Initial Public Offering. The sum contains Rs 5,150 crore of the new issue and makes available for the purchase of scrips of Rs 300 crore by the Bajaj Power Ventures.

What is Bajaj Energy?

The organization, Bajaj Energy Limited was initially corporated as Bajaj Energy Private Limited on August 1, 1988, under the arrangements of Companies Act, 1956 vide authentication of consolidation gave by the Registrar of Companies, Dadra and Nagar Haveli, Gujrat, India. The Company was therefore changed over into a public entity and thusly, the name was changed to Bajaj Energy Limited later.

With a track record of developing, financing and operating thermal power plants, Bajaj Energy Limited along with Lalitpur Power Generation Company Limited is one of the largest private-sector thermal generation companies in India.

Bajaj Energy Limited is one of the biggest private-area thermal power generating companies working in Uttar Pradesh, India.

Bajaj Power, the parent organization of Bajaj Energy is wanting to use the assets raised by the IPO for purchasing the 6,99,36,900 value portions of Lalitpur Power Generation Company from Bajaj Power Ventures and Bajaj Hindustan Sugar for an aggregate of Rs 4,972 crore. The excess sum will be used for general costs and further development.

It has been completely operating since 2012 and has a track record of more than six years of operation. For the fiscal years ending March 31, 2016, 2017, and 2018, respectively.

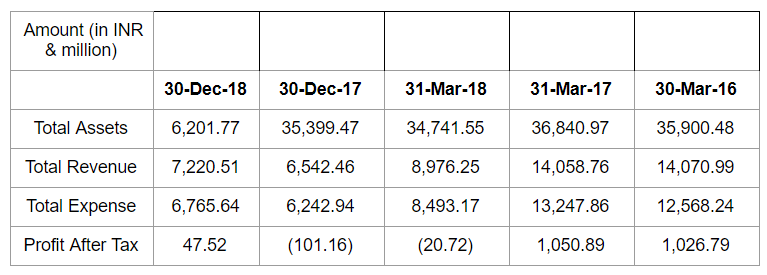

BEL generated a total income of Rs. 7,220.51 million, Rs. 14,070.99 million, Rs. 14,058.76 million, and Rs. 8,976.25 million, respectively, and profit/(loss) of Rs. 395.64 million, Rs. 1,028.35 million, Rs. 1,077.12 million, and Rs. (33.95) million, on a consolidated basis, for the nine-month period ended December 31, 2018, and the years ended March 31, 2016, 2017, and 2018, respectively.

The BEL Power Plants’ average plant availability factor percentage (which is a measure of how much a power plant is available to generate power) was 85.52 per cent, 85.48 per cent, and 87.12 per cent, respectively.

Financial points of Bajaj Energy IPO?

BEL’s total income for the fiscal years ended March 31, 2016, 2017, and 2018, as well as the nine-month periods, ended December 31, 2018, and December 31, 2017, was Rs. 14,070.99 million, Rs. 14,058.76 million, and Rs. 8,976.25 million, respectively.

For the fiscal years ending March 31, 2016, 2017, and 2018, as well as the nine-month periods ending December 31, 2018, and 2017, LPGCL’s total income was Rs. 3,127.44 million, Rs. 31,229.64 million, and Rs. 53,573.24 million, respectively, and Rs. 41,318.42 million and Rs. 41,550.56 million.

According to the Restated Financial Statements, the net asset value per Equity Share was Rs. 34.26 and Rs. 34.02 as of December 30, 2019, and March 31, 2020, respectively.

According to the Restated Ind as Consolidated Summary Statement of Assets and Liabilities, the company’s net worth as of March 31, was Rs. 4,11,75,000 million.

The company’s earnings after tax climbed by 32.4 per cent in the nine months ended December 31, 2018, to Rs. 359.40 million from Rs. 271.44 million in the same period last year.

Bajaj Energy IPO details:

| IPO Opening Date | 2021 (?) |

| IPO Closing Date | 2021 (?) |

| Issue Type | Book Built |

| Face Value | 10 per share |

| IPO Price | ? to ? per equity share |

| Market Lot | ? |

| Min Order Quantity | ? |

| Listing At | BSE, NSE |

| Issue Size | 5450 cr. |

| Fresh Issue | 5150 cr. |

| Offer for Sale | 300 cr. |

What would be the price band of the Bajaj Energy IPO?

The pricing range for Bajaj Energy’s offer will be determined by procedural book-building processes. The corporation has yet to settle on and publicly announce the issue price.

As soon as we receive price information from a reliable source, we will update the page.

Edelweiss Financial Services, IIFL Holdings, and SBI Caps are the issue’s lead managers, while IDBI Capital Markets is the issue’s co-book running lead manager. They will be the book building issue’s book formulating lead chiefs.

What would be the Grey Market Premium of Bajaj Energy IPO?

GMP has not yet been declared, however, we will update the price as soon as we receive official information from our sources.

To receive the most recent information from our website, make sure your notifications are switched on.

What will be the release date for Bajaj Energy IPO?

The Initial Public Offer is likely to be released soon, although officials have yet to confirm a specific date. The IPO is expected to be offered in 2021 after the pandemic situation has calmed down a bit.

However, we will update you when we have more precise information on the date.

How to apply for Bajaj Energy IPO?

You may now apply for the IPO via the standard IPO application process through Zerodha, Upstox, or any other broker; if you don’t know how to apply for an IPO, see our blog on ‘Easy Step by Step guide apply for IPO in India.’

But, to be honest, receiving an IPO allotment is like winning the lottery, and it all rests on your luck. If you are successful in getting an IPO allotment, read our blog on ‘How to make money using IPO in India.’

Because IPO applications are subject to a block of cash with the bank account, select the Auto Pay option while filling out your UPI ID application.

Conclusion:

Bajaj Energy’s initial public offering (IPO) has been making ripples in the market for a few months now. On the IPO listing day, the IPO is regarded as a solid investment opportunity with a good return on investment.

Definitely apply for Bajaj Energy’s IPO Subscription, in my opinion.