What is a Credit Score?

Credit Score or CIBIL (Credit Information Bureau (India) Limited) is a number between 300–900 that portrays the consumer’s reliability.

The higher the score, the better a borrower looks to possible moneylenders. A financial assessment is done using a loan history: number of open records, credit cards, absolute degrees of obligation, and reimbursement history, and different variables.

Moneylenders use financial assessments to assess the likelihood that an individual will reimburse advances in an ideal way.

New to FInance ? Check out These Articles

How to get an 800 credit score?

Why I need a credit score of 800, and the answer is a credit score of 800 and above is considered excellent and with this kind of score, you will be eligible to get loans at lower interest.

Credit Cards are the easiest way to get a score of 800. You should get a credit card as soon as you turn 18. Factors you should be aware of while building your credit score.

1. On-time payment history – ( 35% of your credit score )

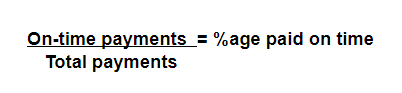

On-time payments are very important in making or breaking your credit history as it is 35% of your credit score and it is calculated as

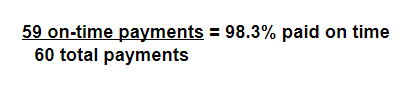

As an example let’s assume you have a credit card for 60 months and you paid your bill on time for 59 months, but you just miss one payment:

And, 98.3% puts you in the average category which is not good if you want an 800 plus score. So never miss a payment and even if you don’t have the full billed amount at least pay the minimum amount due that will not harm your payment history.

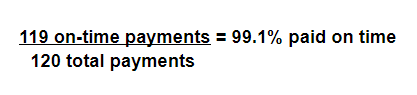

Now how can you prevent this from happening, easy have more credit lines

For example, if you had 2 credit cards for the same 60 months period and again you missed one payment:

And, 99.1% puts in the above-average category. So, have more credit.

2. Credit Utilization – ( 30% of your credit score )

Let us understand this by an example If you have a credit card with a limit of 1,00,000 from which you spend 60,000 rupees and then make the minimum payment.

60,000/1,00,000 = 60% utilized

And, 60% utilization will adversely affect your credit score, from this you are seen as a risker borrower, and the credit bureau will lower your score.

Again if you have a credit card with a 1,00,000 rupee limit and you spend like 80,000 But, you this time pay it in full then you will have 0% credit utilization and your score will be maintained.

You should always try to keep your credit utilization between 0% – 9% to maintain your credit score.

So how to maintain credit utilization:

- Have a lot of credit

- Don’t keep a balance

- Have low utilization

- Try to get more credit

- Always ask for an increase

3. Length of credit history – ( 15% of your credit score )

This one is important to understand as credit history is calculated as the average length of credit history and not the total length of credit history.

Let me explain with an example: if you open a credit card 4 years ago then your average history is 4 years but, if you get another credit card today then your average history will be 2 years.

Important tip: try not to close your old credit lines like old credit cards that you are not using as it will decrease your average credit history.

Now, what should you do to have a good length of credit history?

- Start building your credit as soon as possible and try to keep all those accounts in good standing as long as possible.

- Just have patience – Rome wasn’t built in a day.

- Fun fact according to credit karma you will need an average of 9 years of credit history to get a perfect score.

4. Total credit lines – ( 10% of your credit score )

Try to understand this More credit = higher limit = lower utilization = more on-time payments = increase your overall credit score.

Try to diversify your credit line, don’t be dependent on one, try to get credit like home loans, car loans etc… and pay them on time.

This will show the credit bureaus that you can handle different kinds of debt responsibly and your score will be increased.

Tip: try to make 21+ lines of credit.

5. Total hard inquiries – ( 10% of your credit score )

What is a hard inquiry – each time you apply for a new credit it is reported to credit bureaus as a hard inquiry.

This helps lenders to keep track of how many times you have applied for credit and more hard inquiries makes you seem like a risker borrower.

And you will notice when you apply for a new credit card your score suddenly dropped.

The good thing about this is: it’s on your report for 2 years and only impacts your score for only 1 year after that it is like it never happened.

Conclusion:

At last, if you follow all of the above steps and stay consistent with your credit, you will most likely get an 800 plus score.

Even if you’re reading this article this shows you are dedicated to your financial goals and most likely you will be above average in financial terms which means your credit score will be above average.

You should try to keep your credit score above 760 as scores above that don’t make a huge difference.

Currently, my credit score is 822 last updated on the 9th of April 2021. Comment down your current credit score.

![10 [Must Read] Books on Personal Finance for Indian Investors 6 10 [Must Read] Books on Personal Finance for Indian Investors](https://learn2finance.com/wp-content/uploads/2021/09/10-Must-Read-Books-on-Personal-Finance-for-Indian-Investors-344x194.jpg)