EPF FORM 10C – An Employees’ Pension Fund (EPF) or Employees’ Pension Scheme (EPS) is a retirement plan administered by EPFO for those working in organised industries. Using a Universal Account Number, both the employee and the employer contribute to EPF during an individual’s employment tenure in that specific business (UAN).

The UAN is a 12-digit number that is issued to each EPFO member.

An EPF certificate contains information on an individual’s employment, such as his or her service time and family members who will benefit from the plan in the event of the employee’s death.

When an employee leaves a firm, they have the option of transferring their EPF to their future employer or withdrawing it. In the event of a withdrawal, however, that individual must complete EPF Form 10C.

How to fill EPF Form 10C form?

Form 10C can be submitted both online and by mail. Following a visit to the Employees’ Provident Fund’s official website, the following procedures must be taken in order to fill the online form.

Step 1 – Scroll down and click on the Employers Portal option.

Step 2 – On the following screen, in the Username and password area, enter your UAN number and password.

Step 3 – From the top menu bar, select the “Online Services” tab.

Step 4 – From the dropdown option, choose ‘Claim Forms 10C, 19, and 31.’

Step 5 – On the following page, double-check your employment, KYC, and member information.

Step 6 – For verification, enter the last four digits of your registered bank account.

Step 7 – Accept the “Certificate of Undertaking” terms and conditions.

Step 8 – Scroll down to the bottom of the following page and click on the “I wish to apply for” link.

“Only Form 10C for Pension Withdrawal.”

Step 9 – After providing your address, click the “Get Aadhaar OTP” button.

Step 10 – You will be given an OTP, which you must enter into your form before clicking on “Validate OTP and Submit Claim Form.”

You will receive an SMS confirming the completion of the EPF withdrawal form 10C filing procedure. Within a few days, the collected money will be sent to your registered bank account.

The Advantages of the EPF 10C Form

Form 10C benefits are provided to three groups of members who meet particular qualifying conditions. The qualifying requirements for member type 1 are as follows –

- A person resigned from his employment before finishing his ten-year term.

- A person reached the age of 58 before completing ten years of service.

This group of members can make use of the following benefit:

1. He/she is eligible for PF withdrawal after filing Form 10C for their EPF before permanent retirement.

The following are the eligibility conditions for member type 2 to apply for EPF Form 10C:

- Individuals who have completed 10 years of service before reaching the age of 50.

- People above the age of 50 but under the age of 58.

The following benefits are accessible to such a member:

- Individuals who meet both requirements are eligible for a scheme certificate.

- After completing Form 10D, an individual who meets just the ‘B’ criterion can withdraw a reduced pension.

The qualifying requirements for member type 3 are as follows:

- If the individual is a legal heir or nominee of a dead member, he or she must be over the age of 58 and have not completed ten years of service.

The advantage to such members is –

- The individual is eligible for withdrawal benefits after submitting EPF Form 10C.

If a member has retired owing to a physical handicap, he or she may also withdraw his or her EPS under the disablement pension after completing Form 10D.

The Scheme Certificate, which will be issued to Member Type 2, will also have certain advantages. These are the –

- It serves as documentation of an employee’s years of service.

- If the individual is unable to find work after retiring from their prior position, they can apply for an EPF withdrawal using Form 10C.

- If a member dies before reaching the age of 58, family members or the individual’s legal nominee may withdraw funds from the EPS account.

The following table shows the eligibility criteria for the three types of members.

| Member 1 | Member 2 | Member 3 |

| Did not complete 10 years of service. | Completed 10 years of service before turning 50 years. | Legal heir or nominee of a deceased member, who was past the age of 58 and could not complete 10 years of service. |

| Should be 58 years old when you finished your ten years of service. | Is beyond the age of 50 but under the age of 58. | – |

If a person has only been a member for fewer than 180 days, he or she is unable to get any benefits.

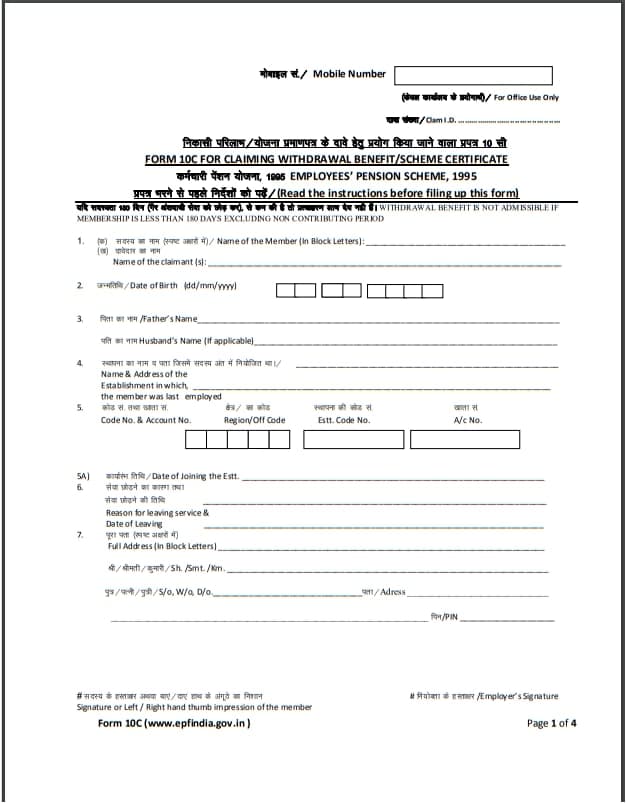

EPF Form 10C Contents:

- The claimant’s name.

- The birthdate

- Name of the father

- Name of the husband (if applicable)

- The address and name of a company where a member worked prior to retirement.

- A region code, a prior company’s formation code, and an individual’s PF account number are all required.

- Joining date in a previous location.

- The reason for departing and the date of departure.

- A claimant’s complete address.

- Confirmation that an applicant will accept a scheme certificate rather than withdrawing benefits.

- Details about the spouse (if applicable), children (if applicable), and legal heir or nominee.

- In the event of a deceased member, include the date of death, the name of the applicant, and his or her relationship to the late member.

- Remittance method – a. postal money order or b. cheque or electronic payment

Example of EPF FORM 10C :

Attestation Procedures:

Depending on the circumstances, the EPF Form 10C must be attested by either the employer or both the employer and the workers. The following are some examples:

In the event that an individual applied using a form obtained from a centre, it must be confirmed by their prior employer.

If the individual obtained the EPF Document 10C online, both the employer and the employee must attest to the form.

If the preceding establishment is a closed organisation, the form can be attested to by the following officials – Postmaster; Magistrate; Chairman or Secretary of District Local Board; Gazetted Officer; Bank manager relevant to the individual’s savings account, President of Village Union or Panchayat.

Documentation is required:

Individuals must provide the following documents throughout the application process:

- a photocopy of a blank or cancelled check

- Children’s Birth Certificates of Members (in case of scheme certificate application).

- If you are the legal heir of a dead member, you must provide a death and succession certificate.

- A revenue stamp of Re 1 must be affixed to the EPF Form 10C.

EPF is a good option for those searching for assured profits. However, the rate of return in such programmes is restricted. Market-linked investment plans, such as Mutual Funds, on the other hand, have the potential to earn significant profits.

Individuals can increase their earnings by investing the money they remove from their EPF account in mutual funds. They can take 75% of the EPS corpus after 1 month of unemployment by submitting Form 10C, and the balance after 2 months.

![10 [Must Read] Books on Personal Finance for Indian Investors 4 10 [Must Read] Books on Personal Finance for Indian Investors](https://learn2finance.com/wp-content/uploads/2021/09/10-Must-Read-Books-on-Personal-Finance-for-Indian-Investors-344x194.jpg)