Cardano, a proof-of-stake blockchain platform invented by Charles Hoskinson and built by the IOHK team, claims to enable “changemakers, innovators, and dreamers” to effect good global change. SundaeSwap will be among the first of these innovators. lets talk about SundaeSwap.

What exactly is SundaeSwap?

SundaeSwap is an automated market maker (AMM) – a decentralised application (Dapp) that allows users to exchange Cardano blockchain tokens anonymously, quickly, and securely.

SundaeSwap, which plans to begin in August 2021 with the release of Goguen, would employ an automated market mechanism to let users to trade against and give liquidity to a liquidity pool (LP), which is supported by platform users in exchange for tokens.

What exactly is an ISO?

They are creating a new type of fundraising known as the first stake pool offering as a consequence of community participation (ISO). Which serves the following purpose: Users that desire $SUNDAE tokens before they are publicly accessible and can be purchased without using the CLI will stake their $ADA coins in a stake pool they create, the fees for which will be substantially higher than a typical stake pool (around 75-100 percent ).

After fifteen days of operating the pool, they will be able to access the wallet addresses of the people who have staked and will be able to airdrop $SUNDAE tokens straight into their wallets equal to the amount they contribute to the pool. A batch of tokens will be distributed at the conclusion of each epoch.

As an example, suppose a group of 10 people contribute to the pool. In this case, at the conclusion of the period, they will state that the team raised 100 ADA and plans to distribute 4,000,000 $SUNDAE. If one person donated 50 of the 100 ADA, they would get half of the $SUNDAE tokens awarded during that era. For the purpose of simplicity, they will suppose that the other nine persons each gave an identical amount, i.e. 5.55 ADA. These nine individuals would each receive around 222,222 $SUNDAE tokens.

One might wonder how this differs from a regular ICO launch, given that huge institutional investors can still stake far more than the average investor. The beautiful thing about an ISO is that they can cap the amounts staked according to the payout; the cap will be high enough that it still makes sense for them to maintain the pool, but not so high that giant investors entirely consume little investors.

Finally, SundaeSwap’s creative method to funding their project and thanking their supporters is on track to disrupt how future initiatives gather cash.

How to get SundaeSwap Tokens?

Tokenomics:

Token Info

Token name: SUNDAE

Policy ID (contract address): TBD

55% of the SUNDAE supply will go to the public, with 5% of the total supply distributed to Initial Stake Pool Offering (ISO) participants among 5 epochs (1% every epoch).

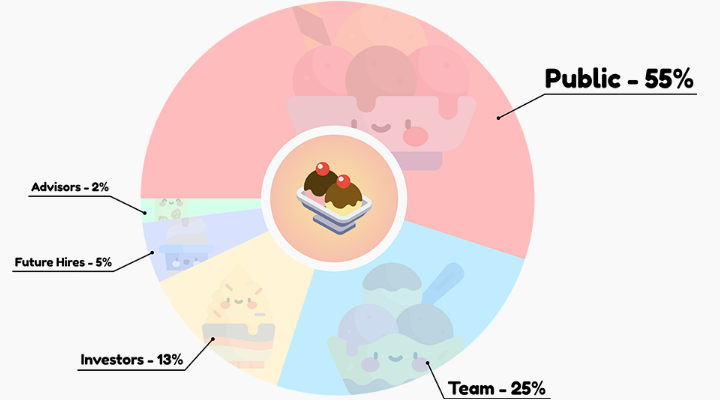

Allocation of SUNDAE

2 billion SUNDAE tokens will be produced at the start of the DEX and will be made available gradually over time as the protocol evolves.

The allocations are listed in the following sequence, from greatest to smallest:

55% of the general public (1,100,000,000 tokens)

25% for the team (500,000,000 tokens)

13 percent are investors (260,000,000 tokens)

Hires in the future: 5% (100,000,000 tokens)

2% are advisors (40,000,000 tokens)

Acquisitions of the Community and Team

Community

The ISO will begin at the moment of the DEX launch, and the SundaeSwap token will be available to users of the SundaeSwap DEX protocol. With the ISO distributing 5% of the total token supply, users will be able to earn additional SUNDAE as incentives for providing liquidity to any XX/SUNDAE pair at launch. Later, users will be able to earn more SUNDAE incentives through yield farming, fee-sharing programmes, and other services that we anticipate will be added to the DEX.

Vesting by Team/Investor

Tokens issued to teams, investors, and advisors have vested and will be distributed on a four-year (team) or two-year (investors/advisers) timetable, with an agreed-upon selling timeline on top of the vesting schedule. Vested tokens are distributed on a pro-rata basis on a monthly basis.

| Years (after launch) | Team | Investors/Advisors |

| 1 | 125,000,000 | 150,000,000 |

| 2 | 250,000,000 | 300,000,000 |

| 3 | 375,000,000 | |

| 4 | 500,000,000 |

Utility:

Governance:

SundaeSwap Labs has been committed to achieving real decentralisation of the DEX from its inception. Our goal is to create the basis for a range of financial products defined by the user community, with the best decentralised exchange at the heart. We’ve helped to build a vibrant ecosystem, and now it’s up to you, the users, to determine what happens next.

SundaeSwap governance will begin with the DEX launch and will be an entirely on-chain experience for users to engage in the protocol’s evolution. Users that contribute to the protocol’s development through governance will be rewarded for their efforts. Tokens can be delegated to a different address for voting purposes. We are committed to “fair launches” in which no one entity has an advantage in getting the governance token, and in order to do so, the Team and Advisors will only vote vested tokens.

SundaeSwap Labs will not manage the development or implementation of a protocol feature or update once it has been voted for, except as an independent developer team.

Profit Distribution:

One of the SundaeSwap protocol’s basic concepts is to decentralise not just access to financial services, but also the revenues earned by them. Holders of the SundaeSwap token clearly play a key part in our project. In exchange for the primary value the protocol offers for the Cardano and larger cryptocurrency ecosystems, it earns money and ultimately distributes that wealth among members of the ecosystem that enabled it. While we haven’t revealed the specific procedures, our objective is for the SundaeSwap token to enable access to these decentralised earnings.

Fee reductions:

We envisage the SundaeSwap token as a vehicle for big volume traders to decrease their overhead: institutional investors, arbitrage helpers, and managed portfolios will be able to pay for trade costs at a lower rate by utilising the SundaeSwap token. This reduces their expense while rewarding these larger volume consumers, resulting in a greater total yield for the liquidity providers.